6.4 Canada ’s Preparedness for Low-Carbon Growth: Detailed State-of-Play – Energy and emissions

Framing the Future: Embracing the Low-Carbon Economy

Energy and emissions

A low-carbon economy is one that functions at a low carbon intensity — emitting low levels of GHGs per unit of GDP.169 What does this involve? For Canada and the rest of the world, achieving low carbon intensities across the economy inevitably involves cuts in energy-related emissions in targeted industrial sectors. Most developed countries and an increasing number of emerging and developing economies are working toward lowering their carbon emissions, either in absolute or relative terms, by improving energy efficiency and replacing GHG-intensive energy systems with ones that have lower or no net emissions. Achieving low carbon intensities also involves promoting current and developing new low-carbon goods and services (LCGS) sectors, such as those discussed in Chapter 2.

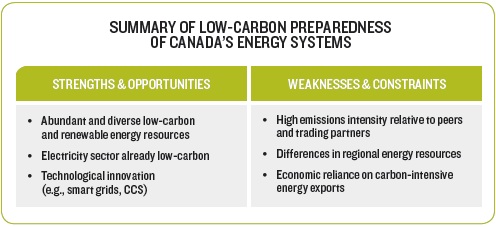

The transformation of Canada’s energy systems will need to be a central component of a low-carbon growth plan for three reasons. First, many of the energy systems across Canada, as well as energy exports, are carbon-intensive and present risks and costs to parts of Canada’s economy in a low-carbon future. Second, energy activities contribute significantly to the economy. Third, diverse energy resources combined with technological innovation and a strong skills base are comparative strengths to be harnessed.

PROFILE IN BRIEF

Canada’s energy sector is a significant contributor to economic well-being. The energy sector accounted for 6.7% of Canada’s GDP and 81% of Canada’s total GHG emissions in 2010.170 The oil and gas service sector, which supports the oil and gas production sector, is a key contributor in its own right, accounting for 4.8% of Canada’s GDP in 2006.171 The energy sector directly employed approximately 264,000 Canadians and was responsible for over one fifth of all new capital investment in the country in 2010.172

But the emissions profile that goes with it presents challenges to meeting environmental goals. Canada’s total GHG emissions in 2010 amounted to 692 Mt, representing about 2% of global GHG emissions or 20.3 tonnes per person (amongst the highest in the world).173 Between 1990 and 2010 total emissions in Canada grew 17%, while in the shorter-term, since 2005, total emissions have decreased 6%.174 From 1990 to 2010, energy-related GHG emissions grew by 95 Mt CO2e. This represents about 92% of the total increase in GHG emissions over that period.175

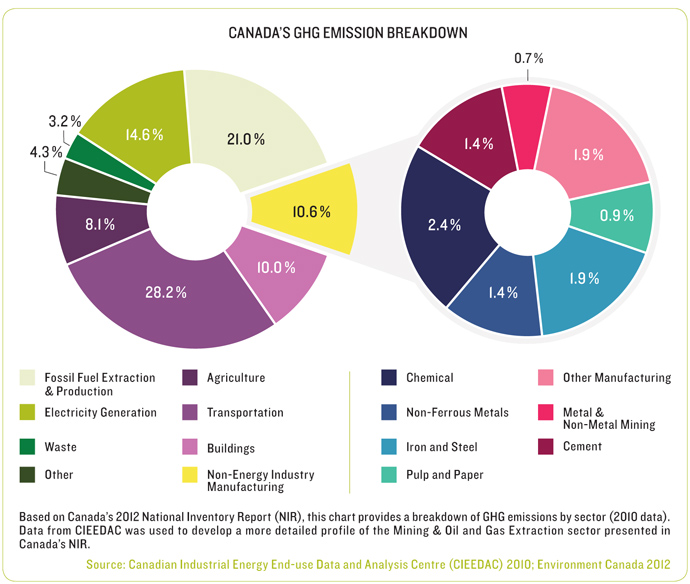

The energy sector is comprised of stationary combustionp emissions, transportation emissions, and fugitive sources of emissions. Stationary combustion alone represents almost half of Canada’s total emissions. Its growth is attributable to an increase in fuel consumed by mining and oil and gas extraction which leaped from about 7 Mt CO2e in 1990 to 38 Mt CO2e in 2010. Another key emissions source in Canada is transportation. Emissions from the transportation sector in Canada increased 30% from 1990 to 2010 in part because of “a shift from light-duty gasoline vehicles such as cars to trucks, minivans, sport-utility vehicles; increased vehicle usage overall; and greater use of heavy-duty diesel vehicles.”176 Fugitive sources denote the intentional and unintentional releases of GHG emissions from coal mining and oil and natural gas exploration, production, transportation, and distribution. Emissions from fugitive sources increased 40%q since 1990 due primarily to growth in oil and gas extraction.177

Regional emissions profiles — both sources and emissions levels — and related economic interests differ markedly and have precluded a comprehensive approach to climate policy to date. On an absolute basis, the majority of emissions in Canada in 2010 originated from just two provinces — Alberta (233 Mt) and Ontario (171 Mt).178 Alberta is the largest energy producer in the country and generates a significant portion of its electricity from thermal sources (55% coal and 35% natural gas in 2011).179 In 2010 Alberta’s electricity and heat generation, fossil-fuel production & refining, and mining and oil & gas extraction accounted for 48.1 Mt, 32.0 Mt, and 29.8 Mt, respectively.180 Its population, energy consumption and transportation emissions make Ontario the second highest emitter in Canada.181 In Ontario in 2010, transportation accounted for 60.7 Mt, and manufacturing industries contributed 15.3 Mt, followed closely by electricity and heat generation with 19.8 Mt.182

Figure 11

In 2010, as a signatory to the Copenhagen Accord, Canada committed to reducing its GHG emission to a level of 607 Mt183 by 2020 — 17% below the level in 2005. As the NRT has shown in its 2012 report Reality Check: The State of Climate Progress in Canada, “Canada will not achieve its 2020 GHG emissions reduction target unless significant new, additional measures are taken.” According to original modelling by the NRT, Canada is on track to achieve just under half of the emissions required to meet its 2020 target, with a remaining 117 Mt gap to close.184 In addition to the federal 2020 target of 607 Mt, each of the provinces has its own target. However, with the exception of Saskatchewan and Nova Scotia, most provinces are not currently in a position to achieve their own targets for 2020 based on existing and proposed federal and provincial policies.185

LOW-CARBON PREPAREDNESS

Because of the world’s dependence on fossil fuels, ceasing production of Canada’s fossil-fuel energy supplies is not a feasible or desirable option in the short to medium term. The challenge for Canada is to define a long-term path that will transition the country from the current carbon- and energy-intensive economies of today, to a future that involves sustainable resource use and substantially lower GHG emissions. Canada’s federal, provincial, and territorial Energy Ministers recognize the onset of a transition to a lower-carbon economy.186 Recent discussions on pan-Canadian collaboration with respect to Canada’s energy future have covered the need to diversify Canada’s energy sources and the importance of long-term transition to a low-carbon economy.

When it comes to energy and emissions, our assessment focused on four indicators of Canada’s low-carbon preparedness: (1) emissions intensity of the economy, (2) industrial emissions intensity, (3) diversification of energy sources, and (4) technology and infrastructure deployment to facilitate the decarbonization of energy systems.

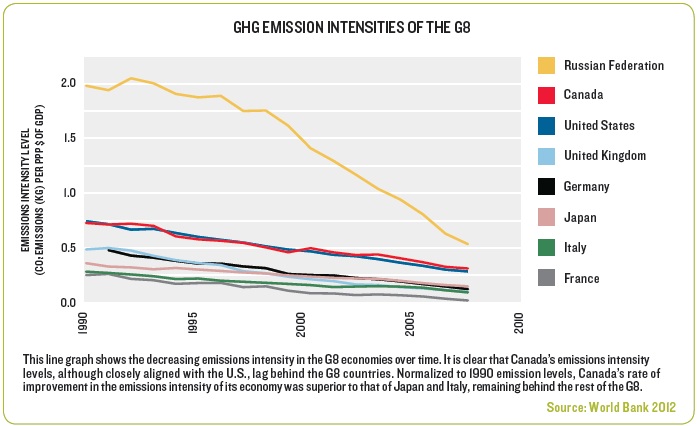

Despite improvements over the past two decades, Canada is one of the most emissions-intensive economies of the G8 (Figure 12) and rests in the middle of the pack among the G20.187 From 1990 to 2007, all G8 countries decreased emissions intensities by over 40% with the rate of intensity reduction being fairly consistent over this period for most countries. Canada’s emissions intensity declined faster between 2000 and 2007 than between 1990 and 2000. Overall, the pace of change of emissions intensity in Canada was on average slightly lower than that of its peers. While recent analysis suggests that Canada’s was one of only a few national economies to reduce its GHG intensity in 2010 as the global economy climbed out of recession, Canada’s overall emissions grew by 2.6%.r Canada is also squarely in the middle of the pack compared with the emerging economies (Brazil, China, India, and the Russian Federation) and countries of strategic importance (e.g., Australia, Belgium, Mexico, Netherlands, Norway, and the Republic of South Korea). A number of this broader group, and in particular, Australia and Mexico are making significant headway in reducing the carbon-intensity of their economies.

Figure 12

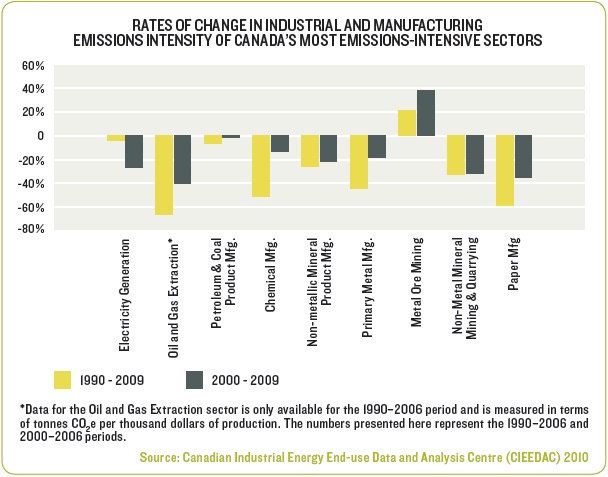

Emissions and growth trends in Canada’s industrial and manufacturing sectors could worsen the emissions intensity of Canada’s economy in the coming years. Figure 13 shows the rate of change in emissions intensity for Canada’s nine most emissions-intensive industrial sectors over two periods.s Three observations are noteworthy. First, the rates of efficiency improvements relative to growth are decreasing for all but electricity generation. Second, some sectors show only marginal improvements in efficiencies (e.g., petroleum and coal products manufacturing) and one is actually worsening (metal ore mining). Third, absent technological innovations, crude oil production in Canada could well become more emissions intensive than it is today, due to enhanced crude production from in-situ oil sands development (as opposed to surface mining).188

Figure 13

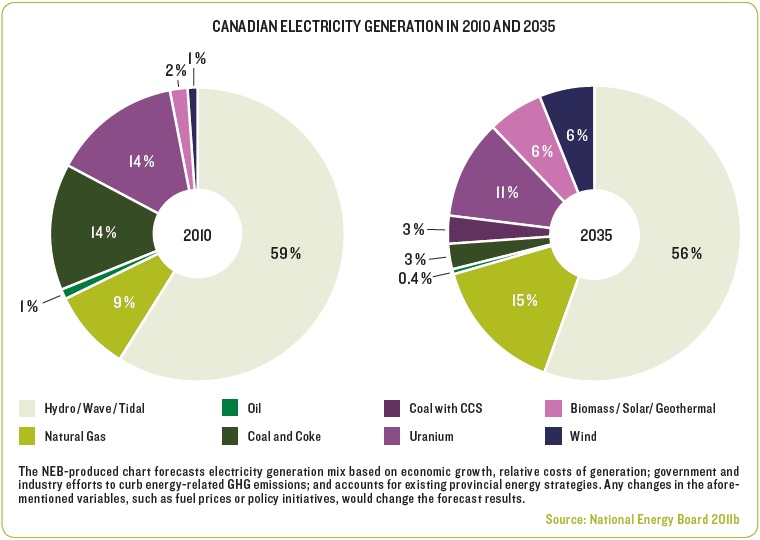

Energy is Canada’s comparative advantage; opportunities exist to decrease reliance on emissions-intensive energy sources by increasing renewable and low-carbon energy supplies, particularly for power generation. Canada has both abundant energy resources and significant diversity in primary energy production and electricity. Compared with the rest of the world, Canada is second in hydroelectricity production and in uranium production and export and third in natural gas exports. It is also poised to expand its renewable energy sources such as biomass, wind, solar, tidal and geothermal.189 Three-quarters of electricity generation in Canada comes from non-emitting or low-emitting sources: hydro, wave, tidal, uranium, biomass, solar, geothermal and wind (see Figure 14). Projections of the Canadian electricity generation mix show continued growth in low-carbon shares, with combined shares of biomass, solar, geothermal, and wind quadrupling between 2010 and 2035.190

Figure 14

Successful reduction in the carbon-intensity of Canada’s energy systems depends on the rate and extent of technology and infrastructure deployment — a process taking place unevenly across Canada with initiatives by both governments and innovative industries. Key technology areas requiring deployment include smart grids, power storage, fuel switching infrastructure, and CCS.

// Smart grids are of interest to all of Canada’s provincial electricity regulators, but two provinces, Ontario and B.C., are moving forward most aggressively by deploying smart meters.191 Smart meters are a necessary step in setting up grids conducive to growing low-carbon energy systems.192

// Power storage is both complementary to and an enabler of smart grids. So far, only Ontario has deployed both demonstration projects and grid-operational projects,193 although small-scale demonstration projects are also occurring in remote areas in Ontario and, to a limited extent, in other provinces.194

// Fuel switching is taking place in power generation via the introduction of biomass for coal generating stations in Ontario.195 Additional fuel switching from coal-fired electricity generation is expected across the country as a result of other provincial initiatives and the new federal coal-fired regulations. The pulp and paper industry has gained ground in substituting biomass for natural gas and the cement industry has increased its use of renewable and alternative sources.196

// CCS is seeing heavy investments by both Alberta and the federal government, with Alberta introducing legislation and regulation to guide the technology.197 Canada is home to eight of the world’s 75 largescale CCS projects, but a recent project termination could imply shifts in the commercial viability of the technology under current market conditions.198

Table 9

[p] Emissions from fuel combustion (e.g., for energy and heat production, manufacturing, construction etc.).

[q] Based on NRT analysis of National Inventory Report data (Environment Canada 2012).

[r] Analysis by PwC (PricewaterhouseCoopers LLP 2011) suggests that in 2010 Canada reduced the carbon-intensity of its economy by 0.4% as compared with most G8 countries which posted overall increases (albeit small). In 2010, for the first time in 10 years, the GHG intensity of the global economy increased. This increase (0.6%) was almost as large as the annual average decrease experienced over the last 10 years (0.7%). Despite Canada’s positive relative performance, its overall emissions grew by 2.6%.

[s] In considering Canada’s industrial and manufacturing sectors and their respective carbon intensity on a per unit GDP basis. There is a clear divide at 0.5 kt CO2e / GDP separating the top nine most emissions-intensive sectors.

[169] National Round Table on the Environment and the Economy 2010

[170] Environment Canada 2012; National Energy Board 2011a

[171] Canadian Energy Research Institute 2010

[172] Natural Resources Canada 2011a

[173] Environment Canada 2012

[174] Environment Canada 2012

[175] Environment Canada 2012

[176] National Round Table on the Environment and the Economy 2012

[177] National Round Table on the Environment and the Economy 2012

[178] Environment Canada 2012

[179] Government of Alberta 2012

[180] Environment Canada 2012

[181] National Round Table on the Environment and the Economy 2012

[182] Environment Canada 2012

[183] Environment Canada 2011b

[184] National Round Table on the Environment and the Economy 2012

[185] National Round Table on the Environment and the Economy 2012

[186] Public Policy Forum 2011a

[187] World DataBank Accessed January 31, 2011

[188] Droitsch, Huot, and Partington 2010

[189] Oliver 2011

[190] Public Policy Forum 2011a

[191] Canadian Electricity Association

[192] Ontario Smart Grid Forum 2009

[193] CPC Energy Storage Working Group 2012; Hamilton 2011; O’Malley, Briones, and Goldberger 2010

[194] CPC Energy Storage Working Group 2012

[195] Ontario Power Generation 2012

[196] Canadian Industrial End-Use Energy Data and Analysis Centre (CIEEDAC) 2011; Cement Association of Canada 2010; National Energy Board 2010

[197] Global CCS Institute 2012a

[198] Global CCS Institute 2012; Project Pioneer 2012