Parallel Paths – 4.3 Permit Allocations and Revenue Recycling to Address Regional Impacts

The distribution of regional impacts across Canada is a key issue dominating the Canadian climate policy debate, but solutions exist.

As we have seen, these impacts are both the result of carbon price differences between Canada and the U.S., and a direct result of Canadian policy choices, independent of the U.S. In a national cap-and-trade system, steps can be taken to moderate or more evenly distribute regional or sectoral effects. In particular, how carbon pollution permits are allocated (free or otherwise), or how revenue from auctioned permits in a cap-and-trade system is recycled back to carbon emitters, drives regional and sectoral impacts. These policy design choices therefore provide an opportunity for Canada to minimize regional impacts and smooth the transition to a lower-emission economy.63

AUCTIONS AND OUTPUT-BASED ALLOCATIONS

- AUCTIONS are one way to distribute permits in a cap-and-trade system; they require firms to bid on all permits required to meet the cap.

- OUTPUT-BASED ALLOCATIONS refers to permits allocated for free, for which the firm allocation is updated based on a current or lagged metric of production such as tonnes of output or value of production. The per-unit allocation is a benchmark based on a sector-wide metric such as an average emissions intensity, a percentage of historical average emissions intensity, or average value added.

Decisions about allocating emissions permits or recycling revenue from an auction of permits are fundamentally about distributing the value embedded in emissions permits. Because permits can be traded on a carbon market, they have value, and this value is effectively assigned to firms when government allocates permits. Similarly, if permits are auctioned, government accrues the value of the permits as auction revenue which it then can distribute to impacted firms, sectors, or households through revenue recycling mechanisms. In either case, this value is substantial. Under a scenario where Canada achieves its target of 17 % below 2005 levels in 2020,64 the value of the permits to be allocated is in the order of $35 billion in 2020.

To address regional impacts65 of Canada-U.S. climate policy directions, the NRTEE explored a range of approaches, using both output-based allocations and recycling of auction revenue :

- PERMITS ARE ALLOCATED to firms based on the value of production, where sectors’ shares of national value-added (GDP) are used to apportion the cap. In theory, this method is similar to a broad-based tax reduction.66 In practice, it can result in allocation values well in excess of compliance costs for some sectors, which may not pass WTO scrutiny.

- PERMITS ARE ALLOCATED to firms based on their historical emissions intensity.

- PERMITS ARE AUCTIONED and a significant share of revenue is recycled to reduce corporate taxes.

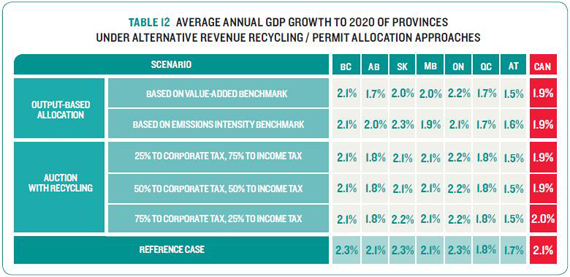

For permit allocations, we focus on output-based allocations because this approach can significantly help the most vulnerable sectors (i.e., those that are emissions-intensive and trade-exposed) to transition to a lower emissions path.67 They were also considered as part of the U.S. policy proposals in Waxman-Markey and Kerry-Lieberman. For revenue recycling, we focus on reducing tax rates (both corporate and income) in order to improve the overall efficiency of the climate policy. Table 12 illustrates the national and regional growth rates under each of these approaches.

The approaches highlight how different allocation and revenue recycling strategies can alter distributional impacts. This effect is important given the differences that exist between the provinces in terms of their industries and emissions intensities. Different allocation or recycling strategies affect the carbon price only slightly.68

The two output-based allocation scenarios in Table 12 illustrate how regional outcomes can be affected by allocation choices. Under the value-added approach, economic growth for Alberta, a region with an economy dependent on emissions-intensive sectors such as the oil sands, sees more significant impacts than less emissions-intensive regions such as Ontario. On the other hand, the impacts on emissions-intensive Alberta and Saskatchewan are significantly reduced if firms are allocated permits based on their emissions intensity. In this case, emissions-intensive firms can achieve compliance with less abatement or fewer purchases of emissions permits on the carbon market. Manitoba is an alternative case in point, where low emissions intensity due to a large hydro power resource translates into a higher overall cost when emissions are allocated on intensity. Similarly, firms in regions like Ontario, which are less emissions-intensive, receive fewer permits under the emissionsintensity allocation approach, and so have to abate more or purchase more permits to comply with their cap.

The revenue recycling scenarios suggest that recycling to corporate tax reductions can reduce the adverse distributional impacts on regions somewhat. The cost of new capital is reduced through lower taxation, which then lowers the cost of deploying new capital to abate emissions — or to invest in oil extraction or other capital-intensive activities. While recycling to income tax does help the other regions, the improvements in GDP are less dramatic. In general, corporate taxation is thought to impose more of a drag on the economy than income taxation, so lowering corporate taxes should result in a more positive effect on national GDP, although the distributional effects across Canadian households of different income and wealth levels will be quite different across the policies.69 The downside of recycling to corporate taxes is increasing regressive effects on low-income households, which would also need to be addressed. With more recycling of revenue to labour or personal income, the labour-intensive regions like Ontario are left slightly better off, but with the trade-off of slightly higher impacts in Alberta and Saskatchewan. This finding supports renewed analysis on how the impacts of climate policy on the emission intensive provinces of Alberta and Saskatchewan are perceived. Appropriate revenue recycling that recognizes regional characteristics can reduce the regional inequities of climate policy.

[63] While a detailed analysis of the very complex issue of permit allocations is outside the scope of this paper, we determined that illustrating how adverse regional and sector-level impacts can be addressed through permit allocation and revenue recycling design choices was an important element to include.

[64] With no cross-border trade with the U.S., and international permits of about 21 Mt.

[65] All allocation and recycling scenarios seek to attain a fixed target or cap of 17% below 2005 in both Canada and the US, with no trading between countries. As we have noted, aligning on targets implies misaligning on price and so results in some competitive disadvantage for Canadian firms.

[66] Fisher, C., and Fox, A. (2007).

[67] Fisher, C., and Fox, A. (2009). Dissou, Y. (2006) suggests that OBAs in Canada result in benefits particularly to energy-intensive industries.

[68] In most cases, the carbon price is not strongly affected by revenue recycling decisions, though output-based allocations can increase the required carbon price because they incent production. Different allocation strategies in Canada relative to the U.S. could affect Canadian competitiveness in a different way since free allocations are effectively a subsidy to certain sectors. Subsidies in one country but not the other could also affect competitiveness, though on a different order than differential carbon prices, given that even if permits are not allocated for free, auction revenue will still be recycled back to the economy in some way.

[69] See NRTEE (2009a); Baylor, M., & Beausejour, L.,(2004); Simonova, E., & Lefebvre, R. (2009).