2011-12 Quarterly Financial Report for the Quarter Ended June 2011

Management Statement for the Quarter Ending June 30, 2011

Introduction:

This quarterly report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. This quarterly report should be read in conjunction with the Main Estimates and Supplementary Estimates.

The raison d’être, or purpose, of the National Round Table on the Environment and the Economy (NRTEE or Round Table) is to play the role of catalyst in identifying, explaining, and promoting, in all sectors of Canadian society and in all regions of Canada, principles and practices of sustainable development.

The NRTEE interprets this broad mandate through a strategic focus on issues of national interest at the intersection of the environment and the economy. It examines the environmental and economic implications of priority issues and offers independent advice on how to address them.

Further information on the mandate, roles, responsibilities and programs of the NRTEE can be found in the NRTEE’s 2011-2012 Main Estimates, available on the following website: http://www.tbs-sct.gc.ca/est-pre/20112012/me-bpd/docs/me-bpd-eng.pdf

Basis of Presentation:

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes the NRTEE’s spending authorities granted by Parliament and those used by the Round Table, consistent with the Main Estimates and Supplementary Estimates for the 2011-12 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before moneys can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

As part of the departmental performance reporting process, the NRTEE prepares its annual financial statements on a full accrual basis in accordance with Treasury Board accounting policies, which are based on Canadian generally accepted accounting principles for the public sector. However, the spending authorities voted by Parliament remain on an expenditure basis.

The quarterly report has not been subject to an external audit or review.

Highlights of Fiscal Quarter and Fiscal Year to Date Results:

The NRTEE’s quarterly and year-to-date spending are in line with that of the previous year. Spending in the first quarter of 2011-12 was slightly less that the first quarter of the previous year. The main variances in expenditures between years are due to decreases of $56K and $52K on Standard Object Information and Standard Object Professional and Special Services respectively. In 2010-11, the first quarter included spending on translation, design and printing of two large reports, which was not the case in 2011-12.

In addition, there was a difference in the amount of spending on the Personnel in the first quarter of 2011-12 compared to the first quarter of 2010-11, this difference is due to a reduction in overtime ($5K) and the timing of the June Plenary. The June Plenary meeting of Round Table Members was a week later in 2011-12, as a result the reimbursement of Members’ salary was only recorded after the end of the first quarter. Overall spending on the Personnel by year-end is expected to be consistent between years.

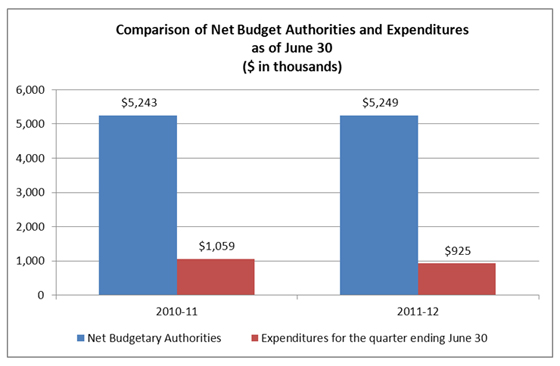

As can be seen in Figure 1, the NRTEE has spent approximately 17.6% of its authorities in the first quarter.

Figure 1 – First Quarter Expenditures Compared to Annual Authorities

Risks and Uncertainties:

The NRTEE is funded through voted annual appropriations. As a result, its operations are impacted by any changes in funding approved through Parliament. Budget 2010 announced that departments and agencies would not be funded for the 2010-11 to 2012-13 wage and salary increases resulting from collective agreements. As departments and agencies must pay the salary increase to employees, organizations are expected to find efficiencies within their operating vote to fund these increases. The Round Table can accommodate this funding pressure in 2011-12 without significantly impacting its operations. Management continues to explore options to address this issue for 2012-13.

The NRTEE is also a knowledge-based organization and as such, relies on maintaining its talented and committed workforce to continue delivering operations and programs.

Significant Changes in Relation to Operations, Personnel and Programs:

There have been no significant changes in relation to operations and programs over the last year. There has been some staff turnover, most notably the Director, Communications and Public Affairs; this position has since been filled.

Approved by,

| David McLaughlin President and CEO |

Jim McLachlan Director, Corporate Services and CFO |

Ottawa, Canada

August 5, 2011

Statement of Authorities (unaudited)

| Fiscal year 2011-12 | Fiscal year 2010-2011 | ||||||

| Total available for use for the year ending March 31, 2012* | Used during the quarter ended June 30, 2011 | Year to date used at quarter-end | Total available for use for the year ending March 31, 2011* | Used during the quarter ended June 30, 2010 | Year to date used at quarter-end | ||

| Vote 20 – Net operating expenditures | 4,809,974 | 815,172 | 815,172 | 4,825,829 | 954,482 | 954,482 | |

| Budgetary statutory authorities (EBP) | 439,195 | 109,799 | 109,799 | 417,491 | 104,373 | 104,373 | |

| Total Authorities | 5,249,169 | 924,971 | 924,971 | 5,243,320 | 1,058,854 | 1,058,854 | |

* Includes only Authorities available for use and granted by Parliament at quarter-end.

Table 1: Departmental budgetary expenditures by Standard Object (unaudited)

| Fiscal year 2011-12 | Fiscal year 2010-2011 | ||||||

| Planned expenditures for the year ending March 31, 2012 | Expended during the quarter ended, June 30, 2011 | Year to date used at quarter-end | Planned expenditures for the year ending March 31, 2011 | Expended during the quarter ended, June 30, 2010 | Year to date used at quarter-end | ||

| Expenditures: | |||||||

| Personnel | 2,879,169 | 754,577 | 754,577 | 2,873,320 | 81,1270 | 811,270 | |

| Transportation and communications | 455,000 | 57,703 | 57,703 | 395,000 | 46,384 | 46,384 | |

| Information | 230,000 | 5915 | 5915 | 196,000 | 62,338 | 62,338 | |

| Professional and special services | 1,357,500 | 48,874 | 48,874 | 1,548,000 | 101,351 | 10,1351 | |

| Rentals | 60,500 | 1712 | 1712 | 51,000 | 4281 | 4281 | |

| Repair and maintenance | 58,000 | 36,178 | 36,178 | 57,000 | 18,231 | 18,231 | |

| Utilities, materials and supplies | 41,000 | 3885 | 3885 | 68,000 | 4858 | 4858 | |

| Acquisition of machinery and equipment | 168,000 | 15,774 | 15,774 | 55,000 | 9417 | 9417 | |

| Other subsidies and payments | – | 352 | 352 | – | 726 | 726 | |

| Total net budgetary expenditures | 5,249,169 | 924,971 | 924,971 | 5,243,320 | 1,058,854 | 1,058,854 | |