2.2 Low-Carbon Growth Potential

Framing the Future: Embracing the Low-Carbon Economy

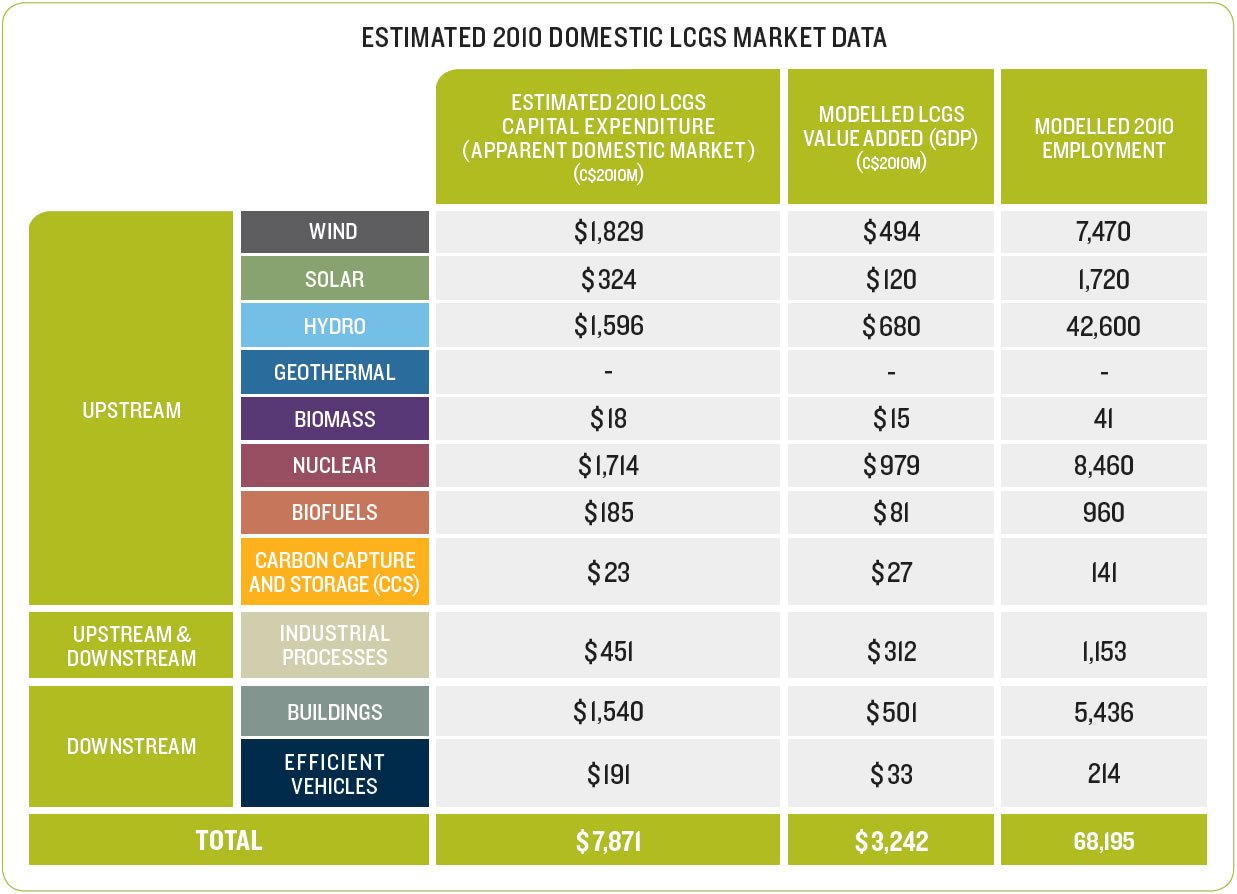

Due to the emerging nature of the LCGS sectors and the difficulty in isolating these “sectors” within national economic accounts, measuring the current size of LCGS economic activity is a challenge. In order to estimate the size of the LCGS market globally, we built on analysis conducted by the International Energy Agency, which forecasts the evolution of LCGS sectors under both a business-as-usual future and a future characterized by a significant carbon constraint, leading to a stabilization of atmospheric CO2 concentrations at 450 ppm. Our estimates of domestic market size were developed using a wide variety of information sources including the CIMS energy-economy model, Statistics Canada data, and a broad literature review (see Appendix 6.2 for a description of our methodology).a Table 4 presents our estimates of 2010 domestic LCGS sector value to the Canadian economy in terms of total expenditures,b gross domestic product (GDP, added value), and employment.

Table 4

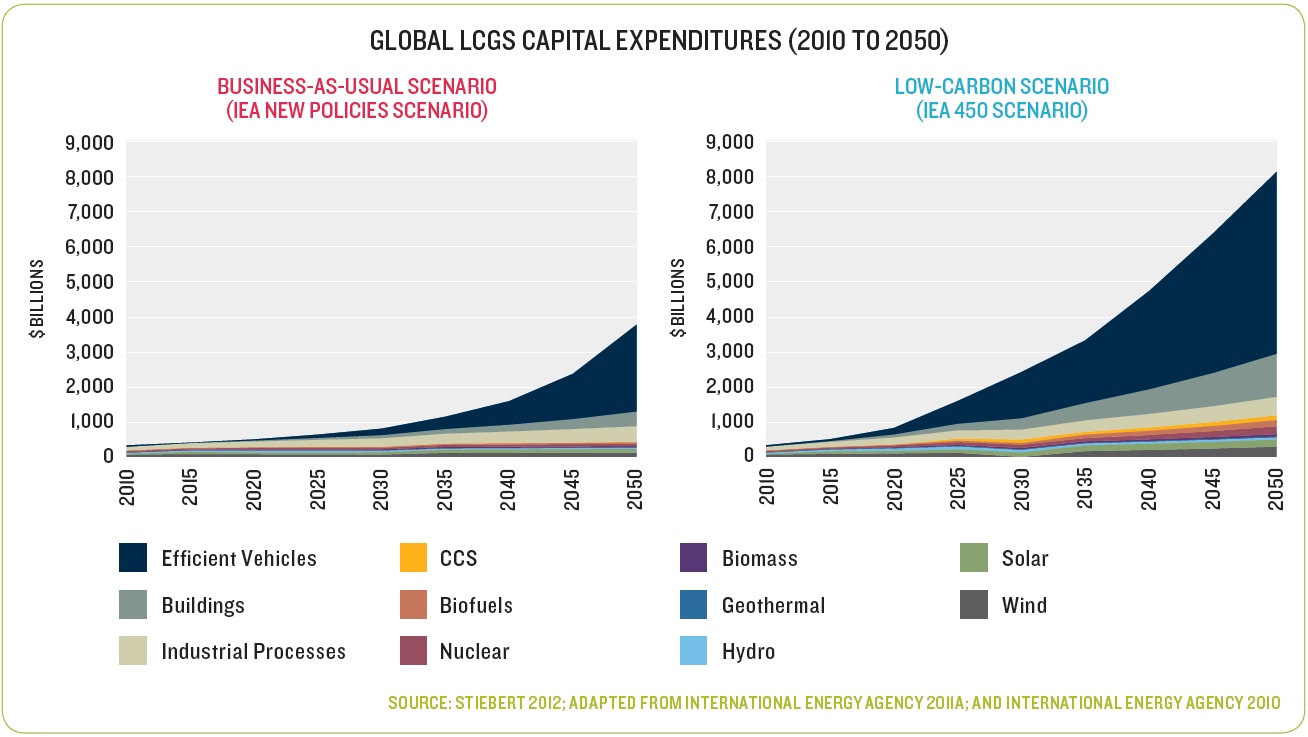

Our extension of analysis undertaken by the International Energy Agency27 suggests that global expenditure on LCGS is significant and growing quickly. Starting from a value of $339 billion in 2010, the global market for LCGS will reach $3.9 trillion by 2050 under a business-as-usual scenario. Estimates of 2050 expenditures more than double under an emissions-constrained scenario, reaching $8.3 trillion in annual spendingc — a growth rate of about 8% annually relative to a growth rate of 6.3% under the BAU scenario. For comparison, in their World Energy Outlook, the IEA assumes an average annual economic growth rate of 3.6% from 2010 through 2035.

As illustrated in Figure 1, global capital expenditures on LCGS are dominated by the efficient vehicles sector. That sector alone accounts for approximately 40% of spending by 2025 and 64% of spending by 2050 in the low-carbon scenario, owing to the rapid turnover rate in vehicle investments as compared with other sectors. Low-carbon buildings and efficient industrial processes account for an additional 12% and 15% respectively by 2025 and 15% and 6% by 2050. Wind and hydro represent a larger portion of the spending in the 2012–2025 period under the BAU scenario together representing over 20% of LCGS expenditures in 2025. However, by 2050 the percentage breakdown of expenditures by LCGS sector is similar to that under the low-carbon scenario with close to 90% of the expenditures distributed among low-carbon vehicles (66%), efficient industrial processes (12%), and low-carbon buildings (11%).

Figure 1

These results demonstrate that there will be considerable new LCGS spending in the years to come. Canadian firms and policy makers should consider how best to position Canadian industries to be suppliers of choice as LCGS markets expand. The results further suggest that regardless of what climate policy path is ultimately taken globally, efficient vehicles, and to a lesser extent low-carbon buildings and efficient industrial processes, will feature strongly as growth sectors.

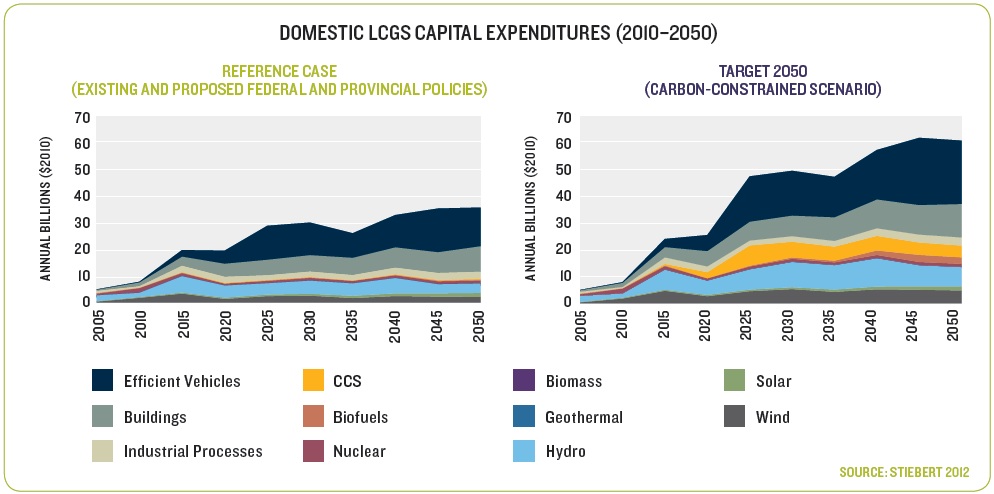

Our analysis establishes substantial growth potential for Canada’s LCGS sectors. Under the Reference Case, total LCGS expenditures in Canada are expected to grow from an estimated $7.9 billion in 2010 to approximately $36 billion in 2050, an annual growth rate of 3.9%. In a more carbon-constrained future LCGS expenditures are estimated at just over $60 billion by 2050, corresponding to an annual growth rate of 5.2%. Under both scenarios, the rate of value-added growth in the LCGS sectors is forecast to substantially exceed average GDP growth.d

Similar to the global results presented above, efficient vehicles and low-carbon buildings comprise a significant portion of the overall domestic spending (Figure 2). Other large domestic expenditures include hydropower and wind, with CCS becoming an important expenditure in the carbon-constrained scenario.

These results demonstrate overall significant growth in domestic LCGS markets over time and show the potential for future policies to influence the size of these markets. LCGS sectors including efficient vehicles, buildings, industrial processes, hydro, solar, and wind are positioned to grow irrespective of future policies. In contrast, significant expenditures on CCS and biofuels are only projected in the context of additional carbon constraint imposed by new policies. The results also demonstrate sizeable domestic market opportunities that merit consideration by Canadian firms as they develop business strategies for the future. For example, Canada’s well-established automobile manufacturing sector will want to consider what actions may be needed to benefit from the growing demand for energy-efficient vehicles. In addition, expenditures on industries supporting low-carbon electricity development such as smart-grid and electricity storage technologies, while not explicitly captured by the modelled LCGS sectors, are anticipated to increase substantially (particularly under the carbon-constrained scenario) as electricity meets a significantly higher proportion of final energy demand and there is increased need for integration of intermittent renewable power sources.

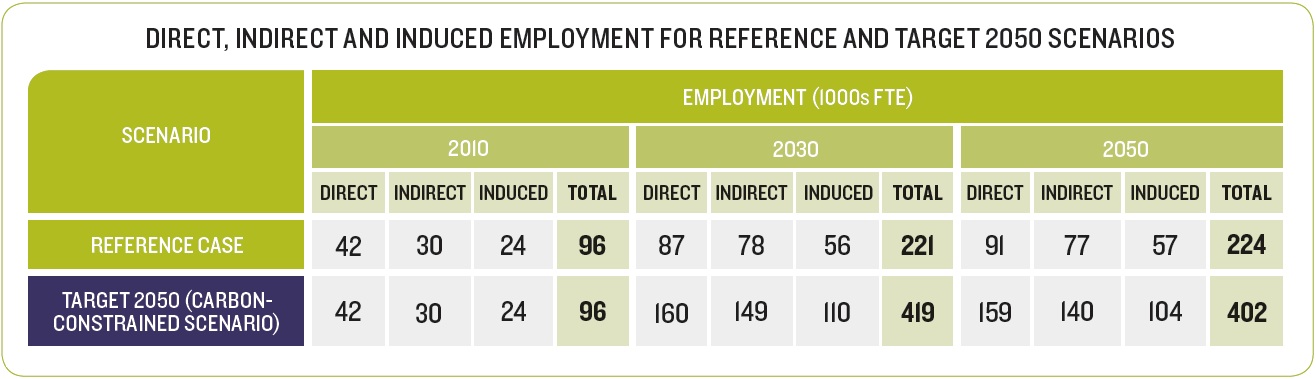

Our analysis estimated that direct employment in the LCGS sectors would increase from approximately 42,000 today to 91,000 and 159,000 by 2050 in the reference and carbon-constrained scenarios respectively. Our analysis further suggested that LCGS investment would require total labour inputs (direct, indirect, and induced) of about 96,000 full-time equivalents (FTE) in 2010 rising to 224,000 in 2050 under the Reference Case and 402,000 under the carbon-constrained scenario. Total cumulative employment in LCGS sectors over the forecast period is estimated to be more than 60% higher under the carbon-constrained scenario.

Table 5

Figure 2

[a] At the request of the NRT, quantification of low-carbon growth potential was undertaken by the Delphi Group in partnership with EnviroEconomics (Delphi Group and EnviroEconomics 2012). Follow-up analysis was conducted by Stiebert Consulting (Stiebert 2012). All reports available upon request.

[b] Our estimates include domestic production plus imports, net of exports, and focus exclusively on capital expenditures.

[c] Compound annual growth rate.

[d] Canada’s GDP compound annual growth rate averaged 1.7% between 2001 and 2010. Under the reference and carbon-constrained scenarios respectively, overall LCGS value-added (GDP) growth is projected to be 3.4% and 5.1%, respectively.

[27] International Energy Agency 2011a, 2010